IRS Small Business Harassment Continues

NTU Defends Small Businesses that use

Micro-captive Insurance

“Small businesses take lawful tax deductions, and the IRS comes after them simply because they can.”

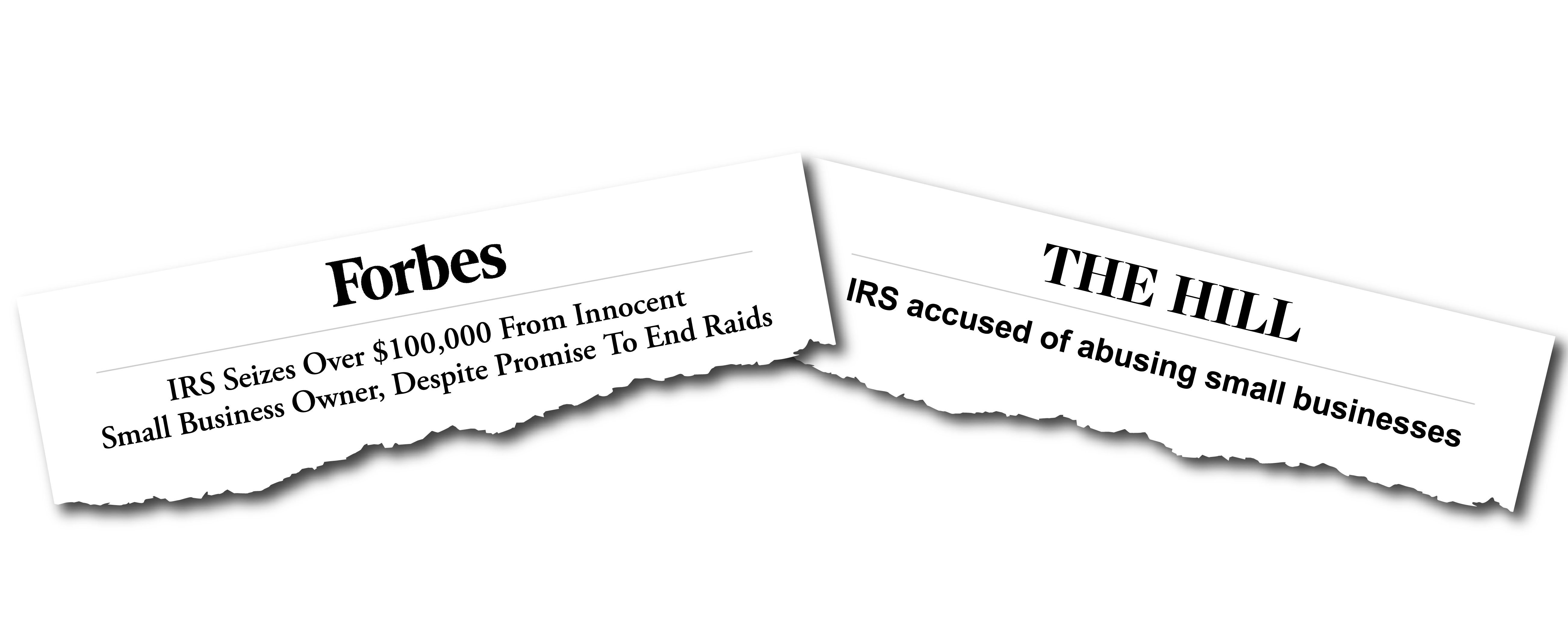

This new video from NTU illustrates yet another example of the IRS’s unfair targeting and abuse of small businesses.

Navigating the Small Business Insurance Crisis

Small businesses are the backbone of our economy, and many are struggling with the impacts of higher energy costs, higher labor costs, and higher interest rates. Recently, the business insurance crisis has caused rates to skyrocket – and that’s if small businesses can find insurance at all.

Small businesses come in all shapes and sizes, and insurance companies can’t always provide the coverage an individual business might need to protect itself. That’s where captive insurance comes in. Captive insurance is a form of self-insurance that large multinational corporations have utilized for years.

Insurance Famine Plagues Nation

THE LIABILITY CRISIS First of a Three-Day Series

February 23, 1986

Following an insurance liability crisis in the 1980s, Congress made it possible for small businesses to self-insure with their own insurance companies, called “micro-captives.”

In 2015, Congress passed the PATH Act (Protecting Americans from Tax Hikes), which encouraged small businesses to employ micro-captives to guard against risk and save money.

But the IRS had other ideas. In their ongoing assault on small businesses, the agency is targeting every single small business that utilizes micro-captive insurance. It is treating any small business taxpayer use of micro-captive insurance as “abusive” and “tax evasion” regardless of the details of the product or the risk that is being mitigated.

The IRS use of “one-size-fits all” treatment of small business taxpayers that utilize micro-captive insurance is clearly harassment. The IRS ignores the justifiable uses of micro-captive insurance to protect small businesses against rare but devastating events – such as pandemics – and treats all taxpayers who utilize these products as guilty of tax evasion until proven innocent, and then provides zero path for due process.

Congress: Stop the IRS from violating the Taxpayer Bill of Rights.

It’s Unfair, Unjust, and a Violation of The Taxpayer Bill of Rights

See Violation

The IRS is violating the Right to be Informed because it refuses to issue clear guidance on the use of micro-captive insurance as authorized by Congress, and instead treats every use of micro-captive insurance as abusive.

Read the Taxpayer Bill of Rights: irs.gov/taxpayer-bill-of-rights

See Violation

The IRS is violating the Right to Challenge in that it makes settlement offers to taxpayers at the inception of an examination on the assumption that all

micro-captive products have the exact same fact pattern with zero consideration about any particular taxpayer’s situation or use of the product.

Read the Taxpayer Bill of Rights: irs.gov/taxpayer-bill-of-rights

See Violation

The IRS is violating the Right to Appeal by forcing taxpayers to settle at the inception of an examination, due to the prohibitive cost of litigation and the unwillingness to consider appeals that deviate from the settlement based on the taxpayer’s actual facts – functionally denying taxpayers the right to an appeal.

Read the Taxpayer Bill of Rights: irs.gov/taxpayer-bill-of-rights